Contribution to EPF will be 12 of Rs46000 which is Rs5520. Answer 1 of 4.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Benefits of EPF Scheme.

. Know EPF or PF interest rate year wise PF interest calculation tax benefits on EPF contribution. College 2019-2024 The Commissioners. So your total salary from above example will be Rs46000.

Jadual PCB 2020 PCB Table 2018. Even if you hike contribution to Rs 4 lakh a year the effective yield remains a healthy 715still higher than PPF. Examples of Allowable Deduction are.

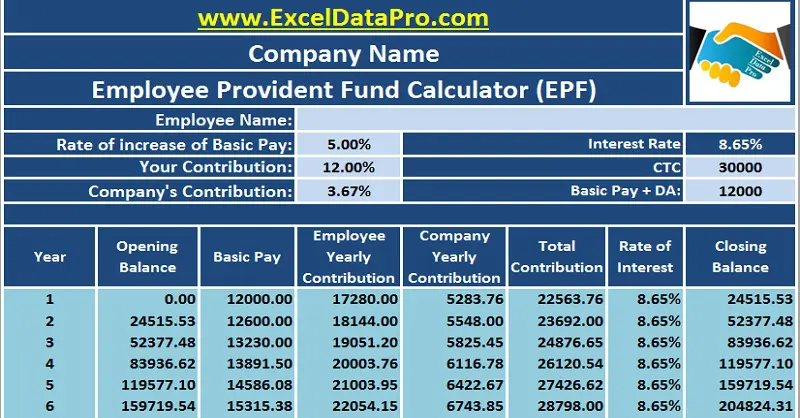

If you are interested to know the calculation of the EPF contribution formula you have came to the right place. Minimum latest 3 months payslip OR latest EPF statement with minimum 6 months contribution. EPF helps in tax saving by keeping EPF contribution tax-deductible with respect to section 80C of the Income tax act1956.

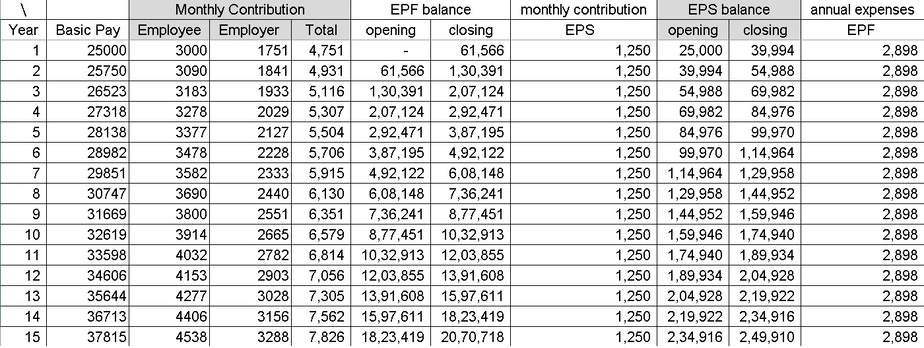

Latest news related EPF withdrawal. Current EPF Interest rate is 85 pa. Employer or companys contribution to EPF is 367 according to the EPF and MP Act.

The updating and uploading of Rules Regulations Notifications etc and linking them with relevant sections of the respective Principal Act under which the said subordinate legislations have been made is the. Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India. The Commission is composed of the College of Commissioners from 27 EU countries.

They are assigned responsibility for specific policy areas by the President. Register with the EPF as an employer within 7 days upon hiring the first employee. Sir EDLIS Administrative charges waived from.

Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance. View the Full Repayment Table here Terms and Conditions.

Register your employees as EPF members and keep their information updated. EPF Self Contribution is an EPF scheme where registered EPF members may make additional contributions to their EPF savings with any amount and at any time. Employers responsibility on EPF contribution.

The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20. January 2 2019 at 343 pm. At First people from all the States in India except Jammu and Kashmir can apply under the provision of the EPF scheme.

25 lakh in a year vide Budget 2021-22. For the Financial year 2019-2020 the pre-fixed rate of interest offered by the EPF scheme is 855. Employer Contribution Basic Salary DA X 367 X 12 months.

Provide salary statements to employees. CIMB Xpress Cash Financing-i Terms and Conditions. EPS contribution will be a maximum of 1250.

Till 31st March 2021. Also EPF withdrawals are liable to income tax if withdrawn before five years of service. Collect your employees share of EPF contribution and submit it to the EPF along with the.

The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May. Act A1611 2019 not more than five shall be employees contributing to the Fund. Updating and uploading of all Central Acts available on this web page is the proprietary of the Legislative Department in the Ministry of Law and Justice.

From above example you may see a cut in your take home pay. However companies with less than 20 employees can join this scheme as well on the basis of Voluntary. EPF Contributions To Be Deducted at 24 from August 1 2020.

Secondly EPF account registration has compulsory for salaried employees with an income of fewer than 15000 Rs per month. Atal Pension Yojana Calculation. The European Commissions political leadership.

Minimum latest 1 month payslip OR latest EPF statement with minimum 6 months contribution. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. You are actually allowed to withdraw legally only if it has been more than two months that you are out of work.

Act A1611 2019 not more than five shall be employers contributing to the Fund and not being persons holding office of emolument under the Government of Malaysia or of a State or employed by any statutory or local authority. But from now onwards it includes BasicDAAllowances. Any extra contribution will go into EPF.

The Government will participate in this co-contribution for five years ie from Financial Year 2015-16 to 2019-20. Together the 27 Members of the College are the Commissions political leadership during a 5-year term. The Government had capped the tax-free interest earned on provident fund contribution by employees to a maximum of Rs.

SIP EIS Table. Since 2020 the default. This includes salaried employees self-employed freelance worker and anyone who wish to better prepare for their retirement.

Move from the current fragmented social security system to an integrated universal one with. In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution. The contribution split equally at the rate of 10 between the employer and.

For instance an EPF contribution of Rs 3 lakh a year will effectively yield a post-tax return of 77 for someone in the 30 tax bracket. Subscribers enjoying the co-contribution cannot be members of any statutory social security scheme and should not be paying income tax meaning their income should be below the income tax threshold. EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000.

Employer contribution will be split as. Both the rates of contribution are based on the total. Decided by EPFO in consultation with Finance Minister.

TDS Tax Deducted at Source is applicable on pre-mature EPF Employees Provident Fund withdrawals of Rs 50000 or more with effective from June 1st 2015. I mandatory state-funded social security for the poor ii contribution-based system for workers earning up to a certain wage with part state-subsidy. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia.

EPF withdrawals at maturity or beyond 5 years attract zero tax in case if premature withdrawal is. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. EPF Contribution Third Schedule.

Employer contribution will be split as. Monthly EPF contribution brought down to 20 for May June and July 2020 will now go back to its erstwhile figure of 24 starting August 1 2020. The new tax on EPF starts pinching for contributions beyond this level.

11 Section 1011 and 1012 of the Income Tax Act provides an exemption for the statutory provident fund and recognized provident fund respectively. More contribution of Rs1920 but less take home from now onward. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act.

Epf Kwsp Dividend Rates 2019 Otosection

Download Kwsp Rate 2020 Table Background Kwspblogs

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

How Epf Employees Provident Fund Interest Is Calculated

20 Kwsp 7 Contribution Rate Png Kwspblogs

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Change Of Contribution Table Ideal Count Solution Facebook

Epf Contribution Table For Age Above 60 2019 Madalynngwf

Chemical Composition Poscoaapc

Epf Change Of Contribution Table Ideal Count Solution Facebook

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Kwsp Dividend Rates 2019 Otosection

Download Employee Provident Fund Calculator Excel Template Exceldatapro

What Is The Epf Contribution Rate Table Wisdom Jobs India

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Epf Contribution Table 2021 How To Calculate Your And Your Employera S Epf Contribution

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55